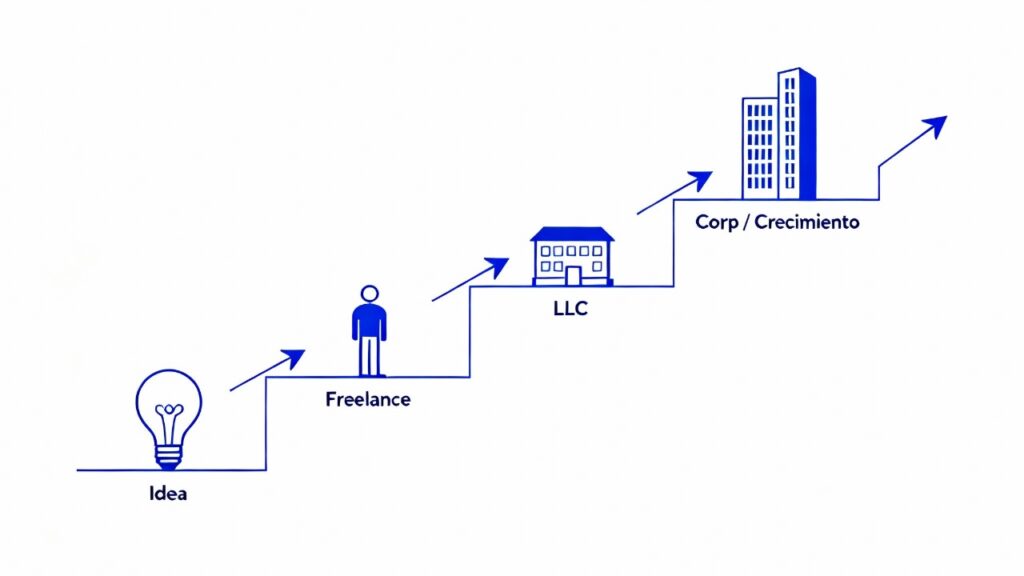

You’ve validated your idea, you have clients in the United States, and money is starting to flow. Everything sounds great… until uncomfortable questions arise:

- Should I create a company in the U.S., or can I keep invoicing “however I can”?

- What happens with taxes if I get paid from Latin America?

- Which legal structure is best for me: LLC, Corporation, or staying as an individual?

Formalizing your business is not just paperwork—it’s the step that separates a fragile project from a business ready to scale, attract investment, and operate without fear of the IRS or local authorities.

In this article, you’ll see—clearly and simply—what it means to formalize your business in the U.S., the legal and tax options available, and how to choose the one that best fits your goals.

What Does “Formalizing” Your Business in the U.S. Really Mean?

Formalizing is not just about registering a company; it involves three core layers:

The right legal structure

Deciding whether you will operate as:

- an individual (sole proprietor),

- an LLC,

- a Corporation (C-Corp),

- or another structure.

Tax compliance

Understanding and meeting your personal and corporate tax obligations:

- what you must file,

- where,

- how often,

- and how to avoid double taxation if you also pay taxes in your home country.

An organized financial system

Separating personal and business accounts, keeping proper accounting records, and having clear reports to support decision-making.

When these three elements are aligned, your business is truly ready to “take it to the next level.”

When Is the Right Time to Formalize Your Business?

You don’t need a large office or a full team to take this step. Clear signs that it’s time to formalize include:

- You invoice U.S. clients on a recurring basis.

- You use platforms like Stripe, PayPal, Amazon, Etsy, or Shopify with growing volumes.

- You want to open a U.S. business bank account.

- You are thinking about raising investment, adding partners, or selling your company in the future.

- You are concerned about making mistakes with the IRS or your home country’s tax authority.

If you identify with at least two of these points, remaining “informal” only increases your risk.

Most Common Legal Options for Entrepreneurs in the U.S.

a) Remaining an individual (sole proprietor)

The simplest path, but also the most limited.

Advantages:

- Fewer initial formalities

- Virtually no formation costs

Disadvantages:

- No separation between personal and business assets

- Fewer tax planning opportunities

- Less professional image for banks and investors

Recommended only in very early stages—and even then, with a solid personal tax strategy.

b) Creating an LLC (Limited Liability Company)

The preferred structure for many Latin American entrepreneurs in the U.S.

Advantages:

- Separates personal liability from the business

- Tax flexibility: by default, it’s taxed as a pass-through, but other elections are possible

- Strong credibility with clients, suppliers, and banks

Disadvantages:

- Ongoing annual filings, reports, and tax obligations

- Not always ideal for raising large venture capital rounds (VCs usually prefer C-Corps)

An LLC is a major step toward formalization and financial order, but it should be part of a broader financial advisory and personal and corporate tax strategy.

c) Creating a Corporation (C-Corp, typically in Delaware or other states)

The standard structure for startups aiming to scale fast and attract institutional capital.

Advantages:

- Well known and widely accepted by investors and funds

- Ability to issue multiple classes of shares and stock option plans

- Strong structure for global growth

Disadvantages:

- Greater administrative and corporate governance complexity

- Pays corporate income tax, and shareholders are taxed again on dividends if not planned correctly

Ideal when aggressive scaling is the priority and you have a clear tax strategy to optimize corporate and personal taxes.

Formalizing Also Means Organizing Your Numbers

Having an LLC or C-Corp is not enough if you:

- Still mix personal and business expenses

- Don’t keep clear, up-to-date accounting

- Don’t understand your cash flow, real profitability, or debt

Formalization must include:

- A separate business bank account

- A cloud-based accounting system tailored to the U.S.

- Monthly reports that clearly show income, costs, taxes, and projections

This is where comprehensive financial advisory comes in—turning financial statements into concrete decisions on pricing, spending, investment, and growth.

The Tax Impact of Formalizing Your Business

When you formalize, three key things change in terms of personal and corporate taxes:

Where and how you file

- The business may have its own obligations (corporate tax, informational filings, etc.).

- You still have personal obligations, now shaped by your role as an owner.

What you can deduct

- A formal structure expands and clarifies deductible expenses.

- It enables more sophisticated planning: tax credits, deferrals, and more.

How double taxation is handled (if you live in Latin America)

- You must coordinate U.S. filings with your home country’s tax system.

- Treaties, tax credits, and structures can legally reduce the overall burden.

This point is critical: formalizing without a strategy can make you pay more tax than necessary—even with the best intentions. That’s why formalization must be done with a clear tax plan.

Benefits of Formalizing: From “Self-Employment” to a Real Company

When you take this step and do it correctly, the changes are tangible:

- Greater trust from U.S. clients: an LLC or C-Corp signals professionalism

- Access to better payment methods and banking services

- Ability to hire, sign contracts, and grow in an organized way

- Higher business value if you seek investment or plan an exit

- Peace of mind: you sleep better knowing you’re aligned with the IRS and your home country’s authorities

Formalizing means moving beyond being an “expanded freelancer” and becoming a true business owner.

How Ubox Supports You Through the Formalization Process

At Ubox, we combine two critical dimensions:

Comprehensive financial advisory

- We analyze your business model, current revenue, and growth goals

- We help you understand how each structure (individual, LLC, C-Corp) impacts your numbers

- We design a financial plan aligned with your company’s reality

Personal and corporate taxes

- We evaluate your current obligations (in the U.S. and your home country, if applicable)

- We recommend the legal and tax structure that best balances protection, simplicity, and tax efficiency

- We implement the strategy: registration, compliance, annual planning, and ongoing support

Our goal is not just to help you form a company on paper, but to build a formal, profitable, and tax-efficient business.

Talk to an Advisor About the Best Legal and Tax Structure for You

There is no one-size-fits-all solution. What works for a Delaware SaaS startup is not the same as what a creative agency in Florida or a Texas-based e-commerce business with Latin American partners needs.

That’s why the next step is not copying another entrepreneur’s structure, but defining your own:

- We review your current situation (income, residence, business type)

- We analyze risks and tax opportunities

- We propose a tailored legal and tax structure with a clear implementation plan

Talk to an advisor about the best legal and tax structure for you and take the step to formalize your business in the U.S. with the support of Ubox in comprehensive financial advisory and personal and corporate taxes.